Warning!

Trading The Lower Timeframes Is Not Recommended...

Today's post is dedicated to the retail trader who may have a small underfunded

account and limited funds.There are many different strategies, systems and robots

that can help a trader to trade the forex market. However over

95% of retail traders lose their hard earned money to

the market and being underfunded is one of many obstacles a retail trader faces

in today's market conditions.

There are many traders that don't have $30,000 thousand dollars to open a true ecn account with a regulated Bank.

A ECN is a fancy word used instead of the word Bank. On average it takes

roughley $30k To trade comfortably. Remember there only two

types of brokers market maker and ecn. Market makers basically create a market by

taking the opposite order against you. In a ECN model when you

win they win as well creating a win win situation. Your goal should be, whether

you realize it or not, is to open a true ECN. Or in other

words trade with a bank not a market maker broker. This article is for those of

you who may have a mini account but still want to trade from the longer time

frames. So let's get started with how you should be trading a mini account of one

to five thousand dollars.

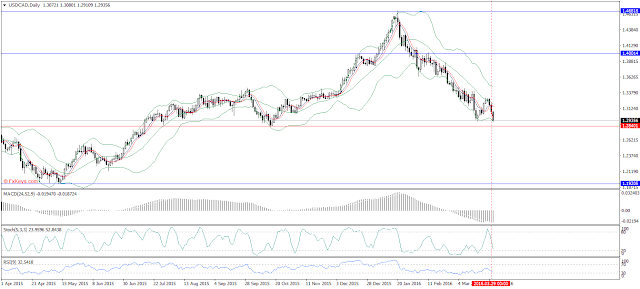

The first thing you want to do is find a setup on one of the higher time frames

like the daily. On the chart below we have a strong downtrend on the usd/cad

daily chart and sense the "trend is your friend until it bends"

we are looking for sell signal right? Right. A doji with confirmation

formed around the middle band. I waited for further confirmation. I got it with

the next bear candle. The bollinger bands had decent expansion which is a sign of

volatility. At this point you pop a vertical line on the candle of interest so

you can see it on the lower time frame.

|

| Usd/Cad Day Price Chart |

You can check the 4hr the 1hr and the

15min and look for a support line or level to be broken. As you

can see i found one on the 15min chart below. Now all you have

to do is wait until the support line has been broken and then you can enter the

trade.

|

| Usd/Cad 15 min Price Chart |

I entered the trade with my stop just above the support line which makes its much

in line with money management rules. You could handle the stop loss on the daily

because of margin limits. I placed my target roughly at a 1:1 ratio. The target

was hit.

|

| Usd/Cad 15 min Price Chart |

So with this strategy you can trade the longer time frame with a small account

and smaller stop loss requirements. Always practice in a demo and get use to any

method you plan to trade live. Never risk more than 2% - 3% of your account on

any given trade so says the money management rules. I hope you gained something of

value from reading this this article. Happy trading!

No comments:

Post a Comment

No Spam Please. Good Luck and God Bless!